Aim: Able to define key words and explain the concept of opportunity cost with refference to wants, resources & choice. |

|

| Revision aid: Basic Economic Problem | |

| Lesson 1 | Wants Vs Resources Tasks Use pages 1-6 to help with this. 1) In your own words explain what the Basic Economic Problem is. 2) Using examples explain what we mean by limited resources. 3) Explain the difference between needs and wants, giving 3 examples for each. Define the follwing words.

4) Resources can be used in different ways (water can be used for drinking, to irrigate crops, to produce electricity). What problem may this create?

|

|

|

| Lesson 2 | Factors of Production & Oppotunity Cost Tasks 1) Define the 4 factors of production (include factors that can affect them). 2) Define Opportunity Cost. 3) Draw a Production Possibilty Curve (use a ruler for the axis) that shows the production of 2 items: 100 pencils or 100 rubbers.

4) Complete Exercise 10 on p.12

|

| Homework: Explain why conflicts arise over the use of resources & try to illustrate your answer with current examples. | |

| Lesson 3 | PPC & Key Words Tasks Using Chapter 2 define the following terms:

|

Aim: To be able to explain how resources are allocated within economies based on supply and demand theories. You should also be able to draw, read and interpret supply and demand diagrams. |

|

| Revision aid: Allocation of Resources | |

| Lessons 4&5 | Shifts along & of the Demand Curve Tasks (Ch.8 in text book) 1) Define: demand, effective demand, quantitiy demanded, individual demand, market demand. 2) Construct demand curve diagram (Exercise 2). 3) Illustrate effect of price change on the curve & reasons for price changes (define extension & contraction in demand) 4) Marginal utility & diminishing marginal utility. 5) Illustrate shifts of the demand curve & reasons for this (define: inferior, complimentary & substitute goods 7) M6 Toll w/s |

|

|

| Homework: Excercise 5 p.160 | |

| Lesson 6 | Supply Curves Tasks 1) Define: supply, market supply, 2) Construct a supply curve (Excercise 6 p.161) 3) Illustrate effect of price change on the curve (define extension & contraction in supply). 4) Exercise 7 p.164 5) Illustrate shifts of the supply curve & reasons for this.

|

| Lesson 7&8 | Market Equilibrium Tasks 1) Define: excess demand, excess supply, equilibrium price. 2) Excercise 8 (p.166) 3) Silver supply & demand w/s (U:2 L:7) 4) Equilibrium Prices w/s (U:2 L:10)

|

| Homework: Market allocation of resources w/s (U:2 L13) | |

|

|

| Lesson 9 | Review Test 40 min test reviewing key terminology & S&D diagrams |

| Lesson 10&11 | Supply & Demand review Tasks In groups: produce a poster for the given option (change in QD, D,QS,S, E point) - include graphs showing the movements, explanations about what has happened & real life examples. Present to the class in 2nd half of 2nd lesson. |

| Homework: | |

Lessons 12&13 |

Elasticity of Demand Tasks 1) Draw demand curves showing difference between elastic & inelastic demand. 2) Formula for calculating PEoD 3) Excercise 12&13 (p.173&4). 4) Demand curves for perfect inelasticity, unitary elasticity & infinite elasticity. 5) Factors affecting PEoD. 6) Excercise 15 (p.178). 7) Income elasticity of Demand |

|

|

| Lesson 14 | Elasticity of Supply Tasks 1) Draw supply curves showing difference between elastic & inelastic supply. 2) Formula for PEoS 3) Excercise 16. 4) Supply curves for perfect inelasticity, unitary elasticity & infinite elasticity.

|

| homework: elasticity applied w/s | |

|

|

| Lesson 15 | Private & Social Costs Tasks 1) Define the following terms (chapter 9):

2) Exercise 1 p.188 3) Externalities w/s |

Aim: understand the role & control of money in the economy. Able to explain individuals employment choices. |

|

| Revision aid: Individuals Choices | |

| Lesson 1 | Role, function and characteristics of money 1) Discussion about what money is & why need it. What makes something suitable as money. 2) What is barter & what limitations does it have. Notes p.394 3) Notes on the function and characteristics of money. 4) Exercise 2 p.396 |

| Homework: The decline of cash | |

|

|

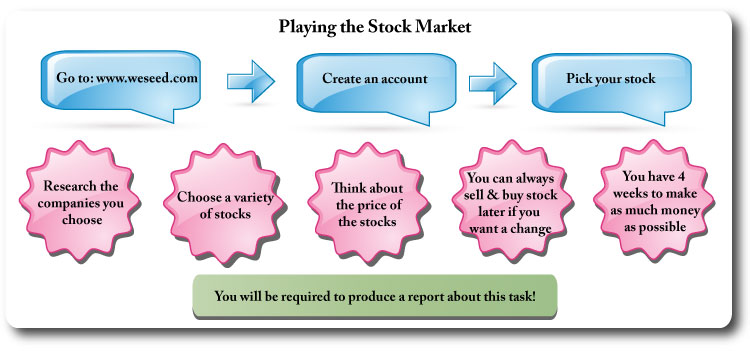

| Lesson 2 | The Banking Sytem 1) What is the central bank and what role does it play? Animation about the federal reserve & its role in the economy 2) Commercial banks & types of accounts that they offer 3) Stock exchange: purpose & types of companies listed Plc & Ltd. 4) Read p.400 & 401, 411 - 414. 5) Ex.9 p.412 Financial terms glossary (not essential for the course but interesting) |

|

|

|

|

| Lesson 3 | Factors affecting Saving 1) Why do people save (purchase something, rainy day, retirement, earn money). 2) What factors affect how much people save (income, age, wealth, interest rates, tax concessions).

|

| Homework: Inflations impact on savings worksheet | |

| Lesson 4 | Individuals job choices & wages 1) Factors affecting individuals occupations (payment & type, fringe benefits, qualifications, location, hours) 2) Why does the amount that people get paid differ? (skills, experience, location, demand/supply, gender, industry sector)

|

| Lesson 5 & 6 | Specialisation 1) Ex 5, p.52 - specialisation task 2) What is specialisation. 3) Benefits of specialisation (to individuals & emloyers) & how it enabled societies to become wealthier. Link back to barter & emergence of money. 4) How do peoples earnings typically change over time. 5) Practise exam Q: (a) Explain what is meant by specialisation and the division of labour. [4] (b) Discuss why some people are prepared to work in low-paid occupations. [6] |

|

|

Aim: Able to describe the different structures of firms and their ownership. Able to define the different costs and explain their significance. |

|

| Revision aid: Private Firms | |

| Lessons 1-3 | Organisation of Firms Tasks 1) Read pages 83-88. 2) Discuss & take notes from the projector. 3) Liability & its implications. Ltds & Plcs, stock exchange and its purpose/function. 4) Co-operatives. Uganda w/s 5) In pairs, poster showing the different firm organisations & the benefits/problems with each + examples. |

| Homework: business structure w/s | |

|

|

| Lesson 2,3 & 4 | Costs 1) Define: plant/factory, firm, industry. p.61/2. 2) Define: profit, costs, revenue, break even point. What are total revenue, average revenue, marginal revenue? 3) Define & explain: fixed, variable, total, average & marginal costs. Draw & label diagrams illustrating the cost curves. 4) firms costs w/s (a) & firms costs w/s (b) 5) Complete Ex.8 p.62-66 6) Complete Ex.9 p.70 ICT Lesson: play: lemonade game & complete the worksheet ICT Lesson: play: coffee game & complete the worksheet ICT Lesson: play Burger Tycoon game & complete the worksheet |

| Homework: finish any incomplete classwork | |

|

|

Cake Bake Activity

Counting the Cost of Baking Cakes

Work effectively as a team to plan and produce a cake based product for sale. You may only make one type of product!! Choose carefully. Consider marketing, pricing & quantities. Record costs & revenues to establish any profit made. Planning is an essential part of any business. Without efffective planning you will struggle to produce a quality product, on time & make any profit. This task requires you to:

Requirements: You must record & keep all receipts from the purchases of raw materials. You must produce the products as a team or at least as a sub-team (not the house-worker!!) Consider portion size & quality control. You have 1 lunch period to sell in (50 mins) You must decide the price of your product based on the cost of making it. You may change the price during the sale period All you sales need to be recorder & if the price changes you need to record sales made at different prices. Any marketing costs need to be recorder for the spreadsheet. As with any legitimate business there are costs in addition to the raw materials. The following will be sudtracted from your revenue: 10% to represent tax. 5000 colones for the rent of the stall location. You must deduct the costs of all raw materials from your revenue (to pay parents back). You must record you costs and revenue in this table. Record the amount of units you sold at each price. Claculate the revenue, subtract the tax & rent & then establish the profit you made.

|

|

| Labour Intensive & Capital Intensive Industries

Capital Intensive Dairy Farming in the Middle East |

|

| Lesson 5 | Productivity & the demand for labour 1) what do we mean by productivity & why is it important? 2) How can firms increase productivity? 3) How do firms decide the number of workers that they need? 4) Complete Ex.7 p.60 |

| Revision - 1 week | Revision End of Semester Exams 1) Structured Qs practise: Exam Qs-(a) (2 lessons). Markscheme 2) Structured Qs practise: Exam Qs-(b). Markscheme 2) Multi-choice past paper (1 lesson) 3) Revision of key words - creating a glossary & revision games (2 lessons). |

| Lesson 6 | Firm Size & Integration 1) How can firms become larger internally? 2) Intergration: horizontal & verticle mergers. 3) Benefits & costs of becoming larger. |

| Review week | Past papers & review of topics from last semester

|

| Homework Exam Qs f ....markscheme (structured Qs) | |

|

|

| Lesson 7,8,9 | Perfect Competition, monopoly & monopolistic competition 1) Read p.202/3 & answer activity 1. 3) Read pages 206-211 & make notes, discuss pros & cons of monopolies. 4) monopoly w/s 6) Monopolistic competition - what is it & the role of advertising. - What is the total value of the chocolate market? - What % do each of the big 4 companies have? - Find out the nationality of each of the 4 companies - Rank the top 10 selling chocolate varieties and put the brand that they are from. 10) groups: poster defining the different market structures. |

| Lesson 10&11 | Video: The Corporation |

Aim: understand and able to discuss the different methods & policies that governments can use to control/influence the economy. |

|

| Revision aid: Role of Government | |

| Lesson 1&2 | Aggregate Demand (AD) & Aggregate Supply (AS) 1) Check understanding of difference between macro & microeconomics 2) Define AD & AS 3) Effects of changes in AD & AS on employment & inflation. 4) AD w/s 5) AS w/s 6) The multiplier effect - explain in own words. |

| Lesson 3 | Circular Flow of Income 1) animation from i-study:

2) Draw own diagram to show what is happening. Include letters for the different factors. 3) National income = National output = National expenditure 4) Equilibrium & disequilibrium in the economy. 5) Define: business cycle, boom, recession.

|

The budget Complete this interactive activity about solving balancing the budget. Read the options carefully and be ready to justify your choices. |

|

| Lesson 4&5 | Monetary policy 1) Reinforce idea of interest rates being the cost of money. 2) Discuss the impact of increasing interest rates: on AD and subsequent economic growth (unemployment & inflation). Also on exchange rates. 3) Impact of changes in the money supply - link to AD & also to possible inflationary pressures linked to output change.

|

| Homework: Interactive quiz online | |

| Lesson 5 | Fiscal Policy 1) Impact of gov changing spending on AD. Discuss examples of this & ways in which gov can be quite specific with the spending choices it makes. Interactive chart showing UK Government expenditure (Guardian interactive) Interactive chart showing UK Government Budget Deficit (Guardian interactive) Look at the two graphics above. Explain how the government could bring the budget back into balance - choose which sector of the economy to cut spending and which taxes to raise - explain your decisions. 2) Impact of changing taxes on AD - will study taxes later.

|

| Homework: Revise for Multi-Choice test | |

| Click here & go to the 4th floor to use the model | |

| Lesson 7 | Review test: June 08 MC (P3) |

|

|

|

|

Aim: Able to explain the different ways in which economic performance is measured and understand the importance of the indicators. |

|

| Revision aid: Economic Indicators | |

| Lesson 1 | What is inflation & the RPI 1) Definition of inflation 2) RPI - what is it, how is it measured, significance of weighting system and base year. Apps included in RPI (guardian 2011) Apps included in RPI (telegraph 2011)

|

| Lesson 2&3 | Causes & effects of Inflation inflation notes PP (password protected)

1) Cost-push inflation 2) Demand-pull inflation 3) Monetary 4) What are the effects of inflation? |

| Homework: cotton inflation w/s | |

| Lessons 4-7 | Unemployment 1) unemployment notes PP (password protected)

Discuss & make notes about causes and effects of unemployment. The Hidden Unemployed in the UK (Guardian Interactive) Video: Mac & Me: decline of motor industry & unemployment issues. |

| Homework: unemployment w/s | |

Output & GDP 1) Define: GDP, Real GDP, Real GDP/capita & discuss advantages of these different measures. 2) What is economic growth. Video: Rethinking Economic Growth |

|

| Story of stuff - externalities, consumption & economic growth. | |

| Revision | Exam Qs g ....markscheme (multi-choice Qs)

|

| Review Week | Refreshing knowledge after Dec break 1) wordsearch & definitions w/s 2) Complete inflation w/s: cost of living changes & Effect on savings/loans |

|

|

Aim: Understand and able to describe & explain the differences in development between countries. |

|

| Revision aid: Development | |

|

|

Measuring Development

|

|

|

|

Population Structure & Change

|

|

|

|

Population Tasks 1)Read p.8&9 - purple book & make a poster about the effects of population changes. 2) Answer Qs on p.11 |

|

|

|

|

|

Aim: Understand the relationship between different economies; trade, currency exchange, international organisations. |

|

| Revision aid: International Aspects | |

| Lessons 1 - 3 | Balance of Payments 1) Definitions: imports, exports, invisible trade, visible trade. 2) Define & understand components of the current account & capital & financial accounts. Read article: telegraph (2011) |

| Homework: complete Accounts w/s | |

| Lesson 4 | Correcting Deficits 1) Methods of deficit correction: deflation, interest rates, protectionism, devaluation. (p.309) |

| Lesson 5 | Trade Barriers |

| Lesson 6-8 | Reasons for trade,Comparative & Absolute Advantage, Specialisation 1) Why do we trade? Why trade w/s 2) What is absolute advantage & examples. buying from abroad w/s 3) What is comparative advantage & examples: comparative advanatge w/s |

| Homework: Story of Trade 1 | |

| Homework: Story of Trade 2 | |

Exchange Rates 1) Define exchange rate: the value of one currency in terms of another currency. 2) Fixed & floating exchange rates & how the Gov can influence the exchange rate. 3) Factors that effect the exchange rate of a currency w/s. 4) Effects of changes in the exchange rate w/s 5) Dirty floating |

|

Review 1) Past paper Qs w/s 2) |

|