Unit 3; The Individual

Unit 3; The Individual

Characteristics of money

Functions of Money

For money to be successful it needs to perform several key functions or purposes.

Central Banks

Central banks act as the government’s bank and are not accessible for individuals and businesses (except commercial banks).

Commercial Banks

Commercial banks are the high street banks that we are familiar with such as HSBC, Barclays and Citibank. Profit maximization is their main aim and they are usually privately owned. They traditionally make most of their money by offering savers a lower rate of interest than they charge for lending out that money to others as loans. Individuals and businesses are their customers and they provide a range of services:

Stock Exchange

Stock exchanges play an important role in economies since they facilitate the buying and selling of shares in Public Limited Companies. This enables companies to raise capital for investment. Stock exchanges regulate the selling of shares and provide a secure marketplace.

Only Public Limited Companies can trade shares on the stock exchange. To buy and sell shares companies and individuals must use a stockbroker. A stockbroker is someone who is registered to trade in the stock exchange on behalf of clients.

Why buy shares?

Wage Factors

Generally the higher the amount of money offered as pay, the more attractive the job is likely to be. The method of payment and performance incentives are also likely to influence the decision.

Non-wage Factors

Trade Unions

Trade unions are organisations that represent workers’ rights. Workers become a member a trade union and then the union will negotiate with employers for improved working conditions, working hours and pay increases. The NUT (National Union of Teachers) and Unison are examples of strong trade unions in the UK.

Trade unions are effective since they often represent a significant proportion of a firms workers. This gives them more influence than if individual workers negotiated separately. The representation of many workers is called collective bargaining.

It also benefits employers since they can deal with a much smaller number of people in making decisions that affect the entire workforce.

If wages levels are pushed too high and not matched by an increase in productivity then this will increase costs for the firm and make it less competitive. This may lead to unemployment – which would be against the interests of the trade union and its workers.

It is possible for trade unions to try and raise the wages for its members through restricting the supply of workers. This can be achieved by requiring specialist certifications or qualifications. Its members refuse to work any overtime hours, or even go on strike (refusing to come into work at all).

Trade unions need to be relaistic since theur actions may also be damaging to the workers since they may find the firm retaliates in some way (through loss of benefits or future unemployment for example).

Specialisation

Specialisation in the sense of individuals refers to the worker focusing their training and experience on a specific part of the production process.

Saving

There are several ways in which people save and different reasons for saving. Reasons for saving

Those on low wages will inevitably spend a large proportion of their income on necessities. This leaves little money for luxuries and saving. People receiving higher incomes are unlikely to spend significantly more on the necessities and subsequently have a larger proportion of their income available for saving.

Borrowing

Borrowing money is likely to feature in most people’s lives at some point. Most people borrowmoney to buy their first house. Others borrow money more frequently to purchase smaller items such as cars and to pay for holidays.

Interest rates affect borrowing. These represent the cost of borrowing money. If interest rates are it will dissuade people for borrowing money since the repayments will be high. If however interest rates are low then borrowing becomes cheap and many people will be enticed to buy now and pay later through borrowing.

Spending

Peoples’ motivation for spending is usually linked to the level of disposable income that they have. If disposable income decreases for any reason, people are likely to reduce their level of spending.

Interest rates often affect spending. If interest rates are rising or high, loans become expensive and people are unlikely to borrow money for large purchases. If interest rates are low or credit is easy to obtain people are likely to increase their expenditure level.

High income groups are likely to spend a larger amount than lower income groups, but importantly this larger amount usually represents a lower proportion of their income. Someone who receives double the income of another person is unlikely to consume twice as much food, water and electricity. This leaves them with more income to save and/or spend on luxuries of they wish.

Unit 3; The Firm

Sole Trader

A business that is owned by a single person is known a sole trader business. The owner may employ other people to work in the company but they have no ownership of the firm. Usually small in size and has low set up costs.

Typical examples are plumbers, electricians and gardeners.

Benefits

Disadvantages

Partnership

These are companies that have 2 or more owners (partners) and usually not more than 20. Common examples of partnerships may are dentists, accountants, solicitors and doctors practices.

Benefits

Disadvantages

Private Limited Company (Ltd)

Private Limited Companies are owned by several people through the sale of shares. The shares are not available to the public through the stock exchange, but sold privately to friends and family. Private Limited companies must publish annual reports for their shareholders giving details about the company’s performance.

Advantages

Disadvantages

Public Limited Company (Plc)

Public Limited Companies are listed on a stock exchange and their shares are available for anyone to buy through a stockbroker. They are often relatively large in size.

To become a Plc, the company must publish information about its operations and accounts in a prospectus to inform any potential investors about the company, its direction and financial health. Each year reports must also be sent to all its investors about the previous year’s performance, accounts and future direction.

Advantages

Disadvantages

Cooperative

These are organizations that are owned jointly by their members and run in the members’ interests. There are several types of co-operatives:

Trading co-operatives

Formed when a group of producers team up to become a cooperative. This is common in agriculture; coffee farmers may form co-operatives to share equipment (reduce costs) and to have more influence in the market place due to controlling a larger supply.

Consumer co-operatives

They buy in bulk to benefit from reduced prices, this is then passed on to their members as cheaper prices.

Public Corporations

These are government run organizations and tend to be large in size. They are funded by the government and are not profit orientated. Their main aim is to provide the best service to the public. Utility and train operations are often state run (nationalized), in the UK the BBC (British Broadcasting Corporation) is a public corporation.

Advantages

Disadvantages

Electronics Manufacturing, China

(Clip taken from the video: Manufactured Landscapes)

Car Manufacturing: Mini, Oxford

BMW are one of the worlds major car manufacturers and produce many of their cars in developed countries where wages are high.

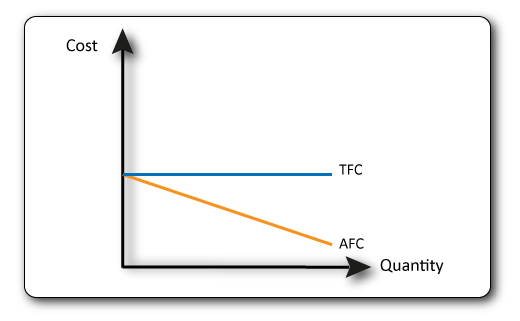

Fixed Costs

These are the costs that don’t vary with output such as rent, interest on loans etc. This means that the Total Fixed Cost (TFC) line is straight.

The Average Fixed Cost (AFC) line is sloped. TFC/output = AFC. If fixed costs are $10 and 1 item is produced then the AFC is $10, however if 2 items are produced then the AFC is $5.

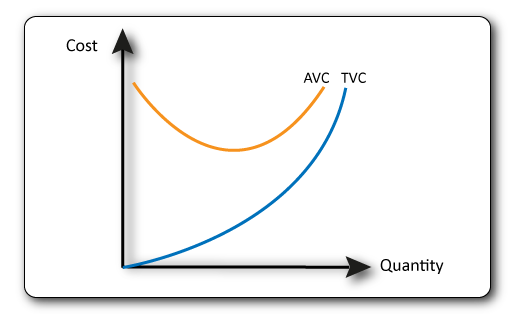

Variable Costs

These are the costs that change as output changes such as raw materials, wages, utility bills. As output increases Total Variable Costs (TVC) increase.

Average Variable Costs (AVC) initially fall as productivity of workers increase and the firm benefits from economies of scale but these diminish and may reverse with increased output. TVC/output = AVC

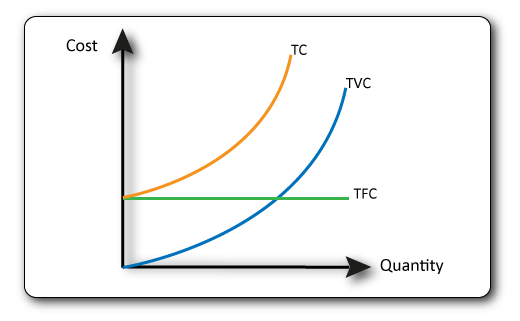

Total Costs

Fixed Costs + Variable Costs = Total Costs.

The total cost line starts at the level of the fixed cost line since these costs must be paid despite no production.

Revenue

Revenue: This is the total amount of money a firms recieves from selling goods (before costs are deducted).

Average Revenue: Total revenue/output

Productivity

The output per worker is known as productivity.

Firms aim to maximise the productivity of their workers in an effort to increase profits. There are several ways in which they may aim to achive this:

Diminishing returns to labour

Increasing the labour force can initially bring increased productivity as many jobs are made quicker through specialization. There are limits though to these benefits and at some point adding additional workers will lead to decreases in productivity.

If workers get in each other’s way, have to wait for shared machinery or cannot communicate effectively, their productivity will diminish, this is known as the Law of Diminishing Marginal Returns.

Perfect Competition

Monopolies

Monopoly situations occur when there is a single firm that is the sole supplier. In some cases it makes sense to have a single supplier since duplicating the infra-structure would be inefficient and wasteful. These industries are known as natural monopolies and include water companies, some rail companies (if they own the track) and electricity suppliers.

Characteristics

Monopolies might have complete control over the supply and therefore be able to set prices, but they cannot control the demand. This leaves them with an important choice. They can either:

Disadvantages of monopolies

Economics Revision e-Guides and e-Textbooks