Revenue and Costs

Sales Revenue is the amount of money a firm receives from selling its products or service in a given time frame (price x quantity). Increasing price does not neccessarily mean an increase in sales revenue - this will depend on the elasticity of the product.

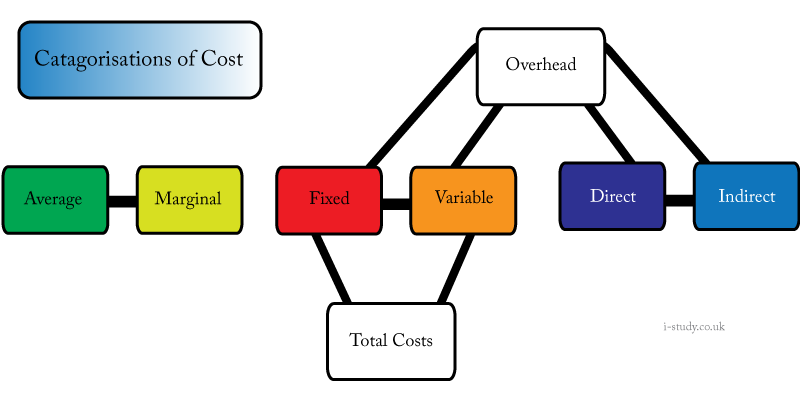

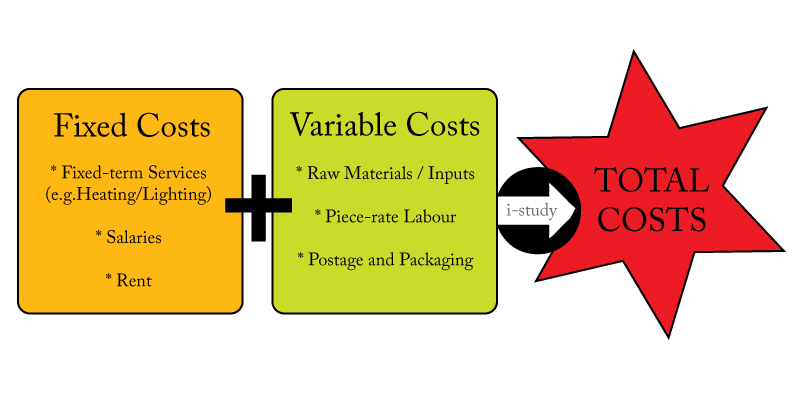

Total Costs is the money a firm spends to produce a product or service in a given time frame. There are different types of costs that make up total costs (fixed costs + variable costs)

1) Fixed Costs - these are costs that do not change as output changes. For example, whether one t-shirt is produced or 100, the rent will still be the same; it has not changed when output has changed.

2) Variable Costs - these are costs that do change as output changes. For example, if one t-shirt were made, then a firm might pay $2 for materials; if 100 were made they would have to pay a lot more. Variable costs therefore relate to inputs. Large companies may negotiate economies of scale to make variable costs rise at a slower rate as they produce more.

Semi-variable Costs -

Contribution Costing

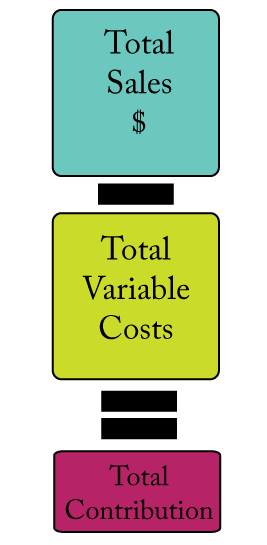

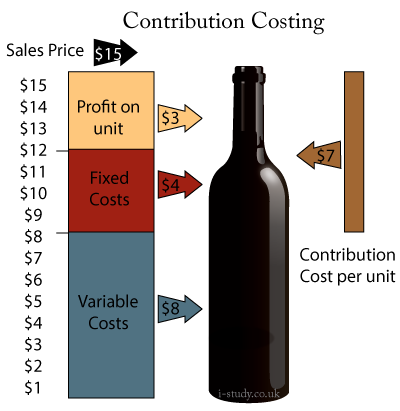

This is the difference between sales price and variable costs. This can be calculated in total (by multiplying the answer by the number of units sold) or per unit. The aim of contribution costing is to determine how much money we are making on that unit.

If given the total contribution cost and the total fixed costs, we could work out profit by subtracting the fixed costs from the total contribution costs.

If a firm was making wine and its fixed costs $4, its variable costs $8 and its selling price $15 per unit, we know that it would be making $3 profit. We also know that the contribution cost of this product is $15-$8 = $7. If they sold 400 units, the total contribution would be ($15-$8) x 400 = $2800.

Methods to increase the contribution per unit:

1) Lower variable costs

2) Selling more

-

Uses of Contribution Costing

- Helps to analyse how much a product is making before fixed costs - this is especially useful for large firms which sell in more than one area

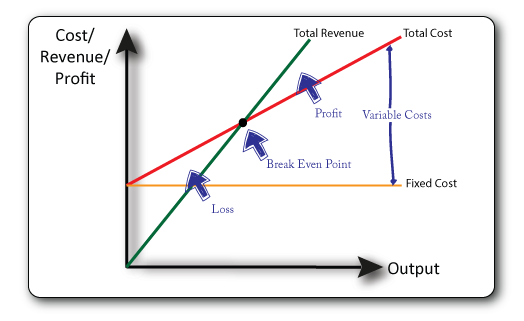

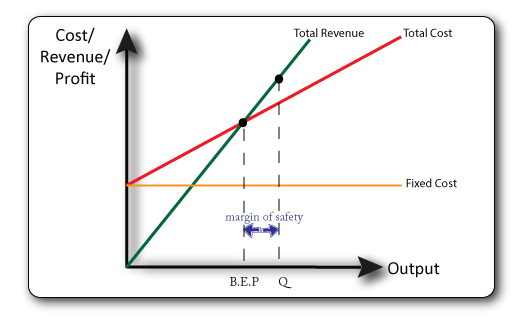

Break even analysis

Benefits of Break Even Analysis

- Helps understand how many units to produce - the margin of safety

- Can be used to illustrate the impact of a change in TR or TC on profits

- Used by banks to decide whether loans should be given

Problems with Break Even Analysis

- Assumes TR remains constant

Target Profit and Target Price

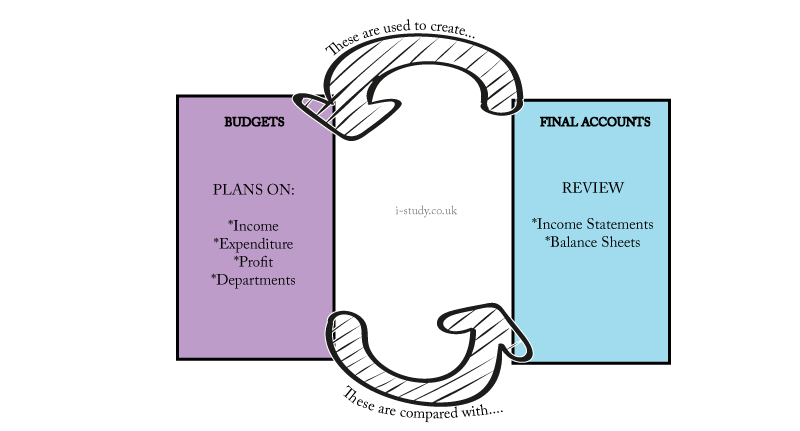

Budgets and Final Accounts

What is a budget?

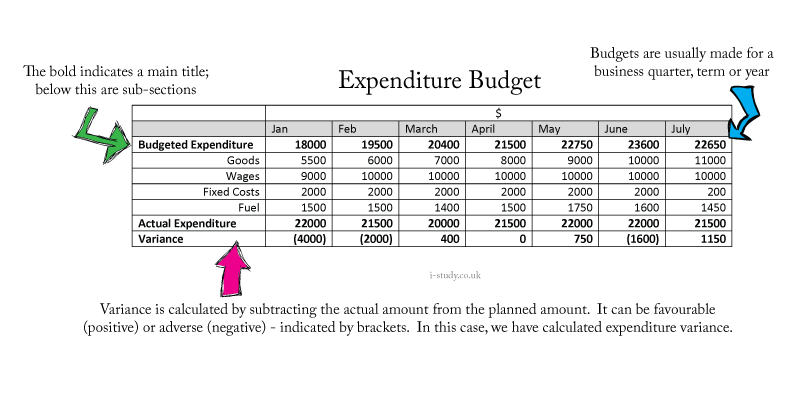

A budget is a target or plan for costs, revenue and other variables that a firm aims to achieve in a given time frame. It is based on the objectives of a business. Firms may have seperate budgets for different variables (e.g. an expenditure budget, a sales revenue budget etc)

What is a budget for?

- To plan for how best to achieve the firm's objectives

- To measure variance

- To give targets and incentives to departments

- To delegate power to relevant departments and thus increase efficiency

- To increase communication

What steps are needed to create a budget?

- Planning

- Comparing

- Analysing variance

Calculating budgets

Problems with setting up a budget

- Past information may be difficult to obtain, especially if this is the first budget set up.

- External factors - sometimes factors outside of the firm's control influence demand or supply of a product. If these are difficult to predict (e.g. a war or an oil crisis) then they will not be budgeted for.

- Co-ordination - planning budgets requires a large amount of co-ordination between different departments. This may take time. This is very true of large firms.

- Opportunity Cost - the time it takes to set a large budget means there is less time spent elsewhere, although the opportunity cost of not setting a budget could be greater.

Advantages of using budgets

- Helps organise marketing mix - managers can identify areas they believe need strengthening and plan accordingly by putting more money into these areas. This helps feed into their vision for the future by prioritising different areas of the marketing mix - for example, by allocating more money for promotion rather than product.

- Monitors performance - using bugets helps allows variance to be calculated and therefore the difference between actual and estimated figures can be identified. Departments with a high adverse variance will therefore be targetted for improvement or allocated more money next time. Similarly departments with a large favourable variance may have their resources reallocated to other areas; it thus allows companies to see where they spend too little or too much.

- Allows for accountability and motivation- managers with adverse variance in their departments will be asked to account for these differences, making room for error less. Managers will be motivated to try and receive the highest incomes and spend the least amount possible in order to generate favourable variance.

Problems with using budgets

- Initial creation

- Lack of long-term vision

- Lack of risk-taking - fear of adverse variance might make managers avoid taking risky decisions and therefore

- Manipulation

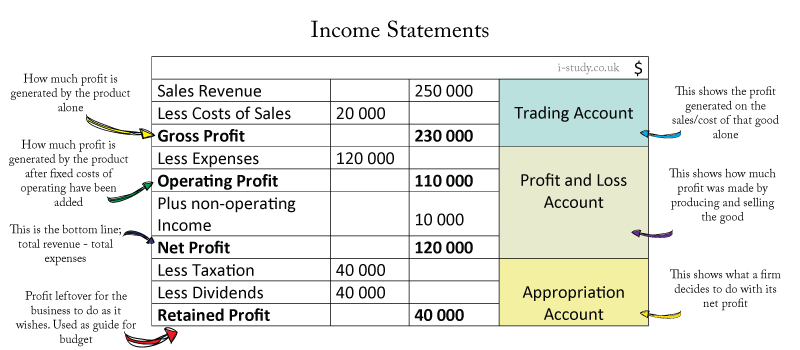

Final Accounts

These are a record of how well a company has done over the past financial year. They are used for decision making purposes, and consist of two key documents: Income statements (also known as profit and loss accounts), and the balance sheet.

1. Income Statement (Profit/Loss Accounts)

Budgets Examined

Read the information in the link and answer the questions below:

http://m.bbc.co.uk/news/business-31830264

1. If, in 2013, E.On reported a profit of €2.14 billion and a loss of €3.2 billion in 2014, how much money had they lost in a year?

2. Explain two reasons why E.On has faced falling proits.

3. Define the term 'impairment charge'

4. Why is there a difference between E.On's operating profit figures of €7 to €7.6bn and net profit of €1.4 to €1.8bn?

Fig 1.1:

a

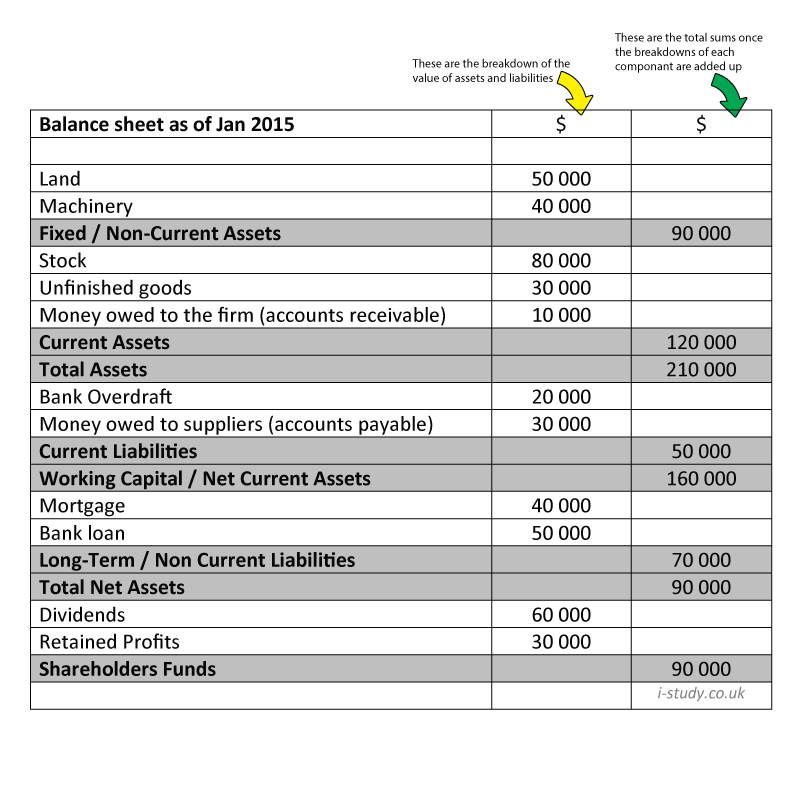

2. Balance Sheet

A balance sheet measures the net value of a businesses assets at any given time. It calculates what a business owes against what it is owns (its assets) and is due.

What is the purpose of a Balance Sheet?

- To inform shareholders of the long-term health of the company

- To provide a guide to banks looking to give loans to the company

What are the purpose of Final Accounts?

1. To act as a guide for progress - measured against objectives

2. To ensure accountability

3. To please stakeholders

4. To see where money is being earnt and spent

Types of Intangible Assets

Cash Flow

Cash flow is the amount of money entering and leaving a firm in a given time frame. Cash flow forecasts predict how much money will be coming in and going out. Firms need cash to purchase materials in order to create products... which generates cash, as illustrated below.

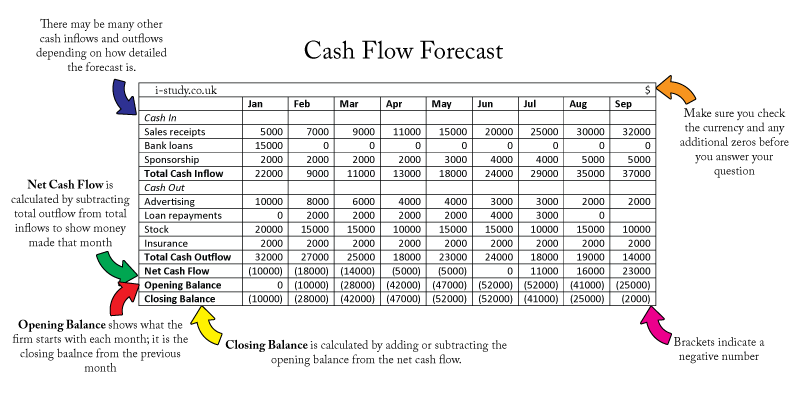

To work out where the cash is going in a business, firms use a Cash Flow Forecast. This is a prediction for a period of time as to where money is going to enter or leave a firm. It is reorded as below.

Problems associated with poor cash flow

Methods to improve cash flow

1) Increase cash inflow

2) Reduce cash outflows

3) Internalizing costs

4) Additional funding

Investment

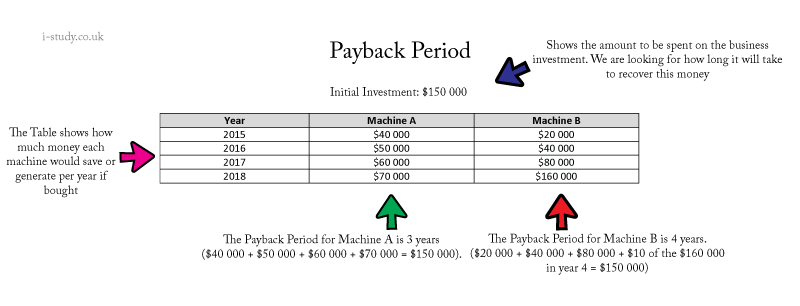

Making an investment is risky business. To calculate how quickly they will recover a loss incurred after an investment, firms can use two methods; the Payback Period and the Accounting Rate of Return

1) Payback Period

This is designed to show how quickly a firm will recover the money it has put into an investment. If for example, a company invested in a new promotional activity that cost $100 000 but was expected to increase sales by $100 000 in the first year alone then the payback period would be one year. By comparing different options' payback period, firms can decide on which investment will give them the quickest return on their money.

Problems with the Payback Period

- Does not show which option is most profitable in the long run

- Assumes external factors will not change the payback period (e.g. rate of interest / inflation)

- It is difficult to predict figures over many years

Uses of the Payback Period

- Useful for businesses in a fast-changing industry

- Useful for shareholders who want to invest in a company with a quick turnaround

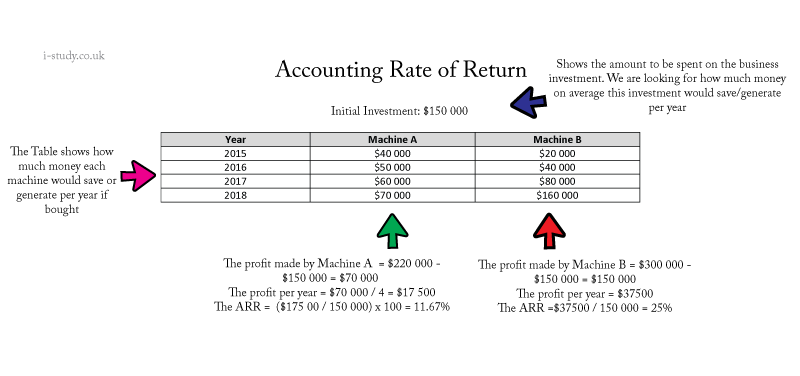

2) Accounting Rate of Return

This seeks to show how much of a return a company will gain per year on its investment, as a percentage of the initial outlay. For example, a firm that spends $100 000 on a project estimated to last 5 years might earn $220 000 at the end o the 5 years. The profit gained from the project is $120 000 ($220 minus the initial outlay of $100 000). Per year this is $24 000 profit. As a percentage of the initial investment this is 24% (24 000 / 100 000 x 100). So, we expect a return of 24% every year on our initial outlay. As a rule, the following three steps are a helpful way to remember this:

1) Calculate total profit

2) Calculate profit per year

3) Calculate profit per year as a percentage of the initial outlay.

Problems with ARR

- Does not take into account time. ARR assumes that the money earned at the end of the time period is worth the same as the money earned at the beginning - this may not be true due to inflation.

- May leave a firm short of cash flow. Unlike Payback Period method, ARR assumes a firm can cope for longer periods of time before earning back their initial investment; if a firm needs cash, this method would not be good.

Net Present Value (NPV)