Why Businesses Need Finance

Firms need finance (or capital) for a range of reasons. These include:

Types of Capital

Types of Finance

Internal vs External Finance

An internal form of finance is one which is raised from within the company, whereas an external form of finance is one raised from outside the company.

Examples of internal finance:

Examples of external finance:

You can read more about these in our revision notes (click on the store above)

Factors to consider when choosing finance

There are many things to consider when deciding where to get your company's capital from. These include:

Ultimately companies must choose the option that suits their business best.

Cash Flow

Cash flow is the amount of money entering and leaving a firm in a given time frame. Cash flow forecasts predict how much money will be coming in and going out. Firms need cash to purchase materials in order to create products... which generates cash, as illustrated .

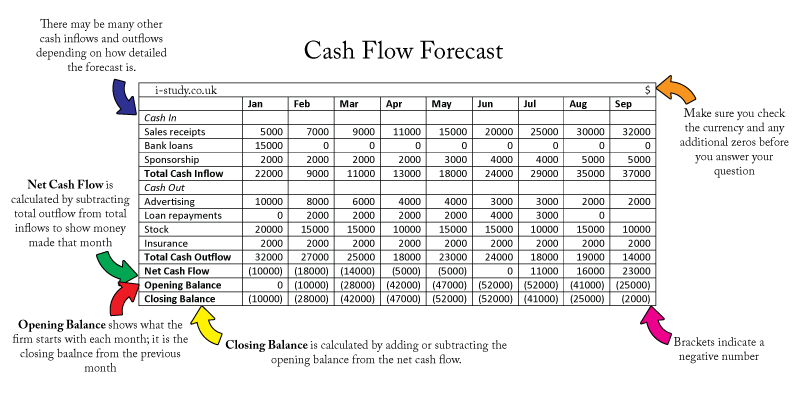

Cash Flow Forecasts

Cash Flow Statements are financial documents that show where the cash in a firm is going in and coming out. They can be made over any period of time, and even projected into the future. The table above shows the different features of a cash flow statement. You may be asked to fill one in, so be sure to look at Figure 2.2 to work out exactly where things go.

Cash Flow Problems

Cash flow problems occur when cash inflows are smaller than cash outflows

Read the following article:

http://www.bbc.co.uk/news/uk-32377013

Remember, for additional notes on this topic, see our revision guide in the store.

Cash Flow Solutions

To get better cash flow, the following methods could be use. Firstly we can identify ways to increase inflows

Alternatively, we could see ways to decrease outflows

Final Accounts

Final accounts are documents a firm needs to submit at the end of the year to show their overall value. It includes two documents

These will now be considered in turn, below. Be careful with your definitions as the example on the right shows!!

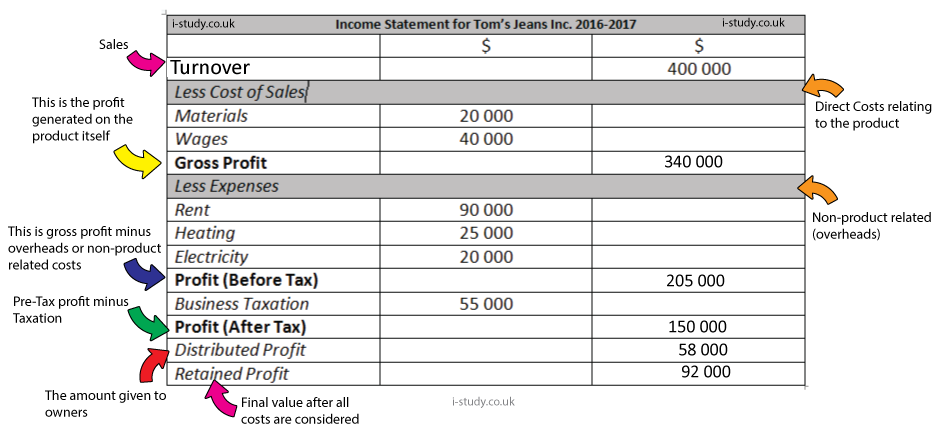

Income Statements

Income Statements are also known as Profit/Loss Accounts. They Show the final profit/loss made by a firm in a financial time frame. It is often split into three sections - the trading account, profit/loss account and appropriation account (though these terms are not needed for IGCSE). Things to spot on an income statement include:

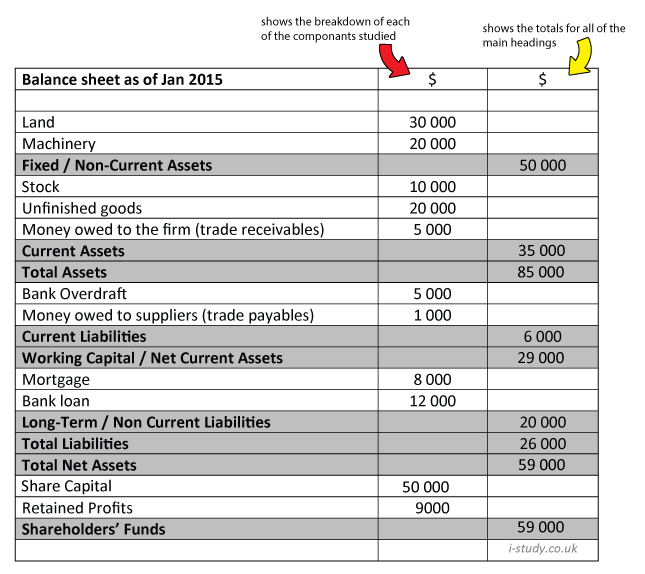

Balance Sheets

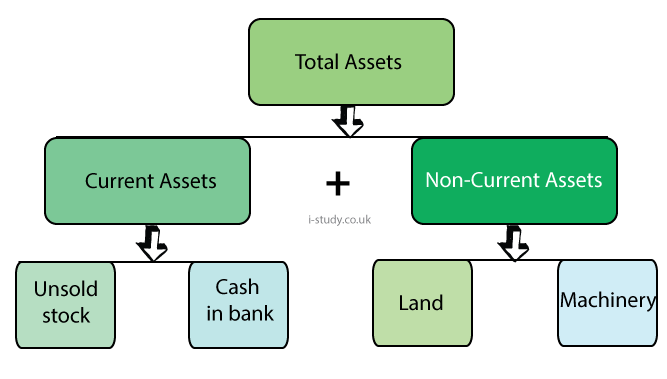

Balance Sheets are the second part of Final Accounts. They are used to show the total net assets of a company. This means, its total value, including all of the things it owes, and everything it is owed. Items of worth that a company owns are called assets whilst items that a company owes other people are called liabilities.

Types of Assets

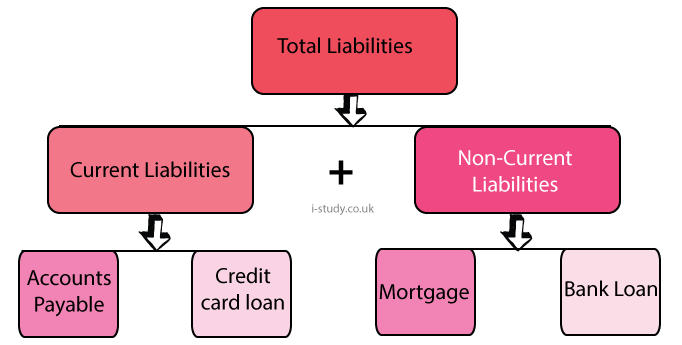

Types of Liabilities

Ratio Analysis

Use the following information to calculate the:

Use the following information to calculate the liquidity ratio for the firm at hand:

For more information on how to do this, purchase our revision notes in the store, above!