Unit 4; Government Policies

Unit 4; Government Policies

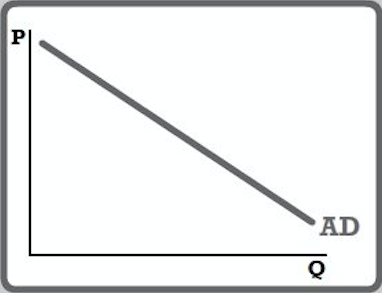

Aggregate Demand

This is the total demand in the economy.

It is made up of:

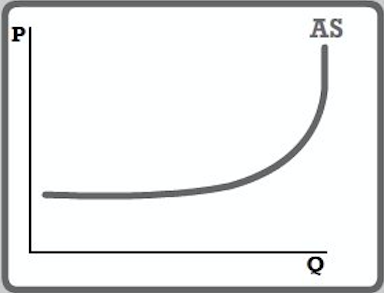

Aggregate Supply

This is the total supply in the economy.

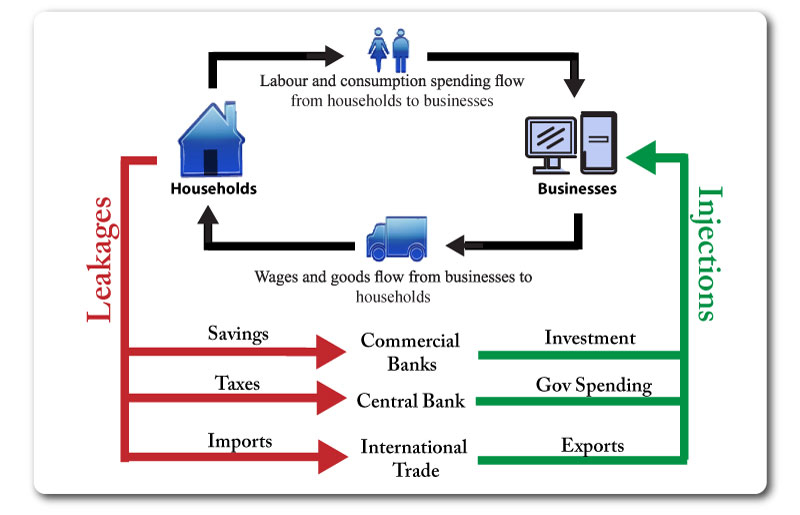

Figure represents a simplistic model of an economy.

Leakages

Injections

Government Aims

Government Production

Governments may provide goods/services that are a natural monopoly (water/electricity).

Essential goods such as health care, education and police forces are often provided by the government.

Governments may provide merit goods such as public swimming pools, libraries and sports centres.

Government Employment

Monetary policy

Key Characteristics

This focuses on controlling changes in the money supply, interest rates & exchange rate.

Contractionary Monetary Policy: raising interest rates and reducing money supply to reduce AD.

Expansionary Monetary Policy: reducing interest rates and increasing the money supply to increase AD.

Fiscal Policy

Key Characteristics

This focuses on changes in government expenditure and taxation.

Reflationary Fiscal Policy: increasing gov spending and reducing taxation to increase AD.

Contractionary Fiscal Policy: reducing gov spending and increasing taxation to reduce AD.

Market Orientated Supply Side Policies

Interventionist Supply Side Policies

Taxation Aims

But taxation itself is a general term, as there are different types of taxes. In general we can identify:

Tax Systems

Progressive Taxation

With a progressive taxation system, citizens are put into ‘income earning bands’ and charged taxation according to these bands. The higher your income, the greater percentage of taxation that you need to pay on income in a particular bracket.

Regressive Taxation

Regressive taxation is the opposite to progressive taxation; the higher your income, the less percentage you pay in tax. Once again, citizens are allocated a tax band and must pay accordingly.

Proportional Taxation

In this case, citizens pay the same percentage in tax, regardless of their income. There are no tax bands – everyone pays the same % - for example 10%. If you earn $100 a year, you thus pay $10. If you earn $100 000 a year, you pay $100. Again, note that the amount each person pays is different but the percentage is the same.

Unit 4; Macroeconomic Indicators

Measuring Inflation

The Retail price Index (RPI)

Causes of Inflation

Cost-Push Inflation

Demand-Pull Inflation

Monetary

Effects of Inflation

Measuring Unemployment

Measured as the % of the labour force who are willing & able to work and looking for a job.

Methods for measuring unemployment vary & generally the official rate is lower than the actual number of people looking for work.

Types of Unemployment

Effects of Unemployment

Measuring Output

Gross Domestic Product (GDP)

Definition: The total value of the goods and services produced in an economy over a given time period.

This is the standard measurement but there are several variations that are used to provide a clearer picture of what is happening in the economy.

Measuring Quality of Life

Human Development Index (HDI)

This is an index that takes into account 3 factors (each is an index itself):

It generates a score between 0 and 1. The closer to 1 the higher the quality of life.

It is considered a better measure of overall development then GNI or GDP because it takes into account social factors aswell as purely economic ones.

Economics Revision e-Guides and e-Textbooks